Malaysia, one of the founding members of ASEAN, is a strategic hub for East-West trade. Known as one of the "Four Asian Tigers," it boasts a diversified emerging industrial economy.

-

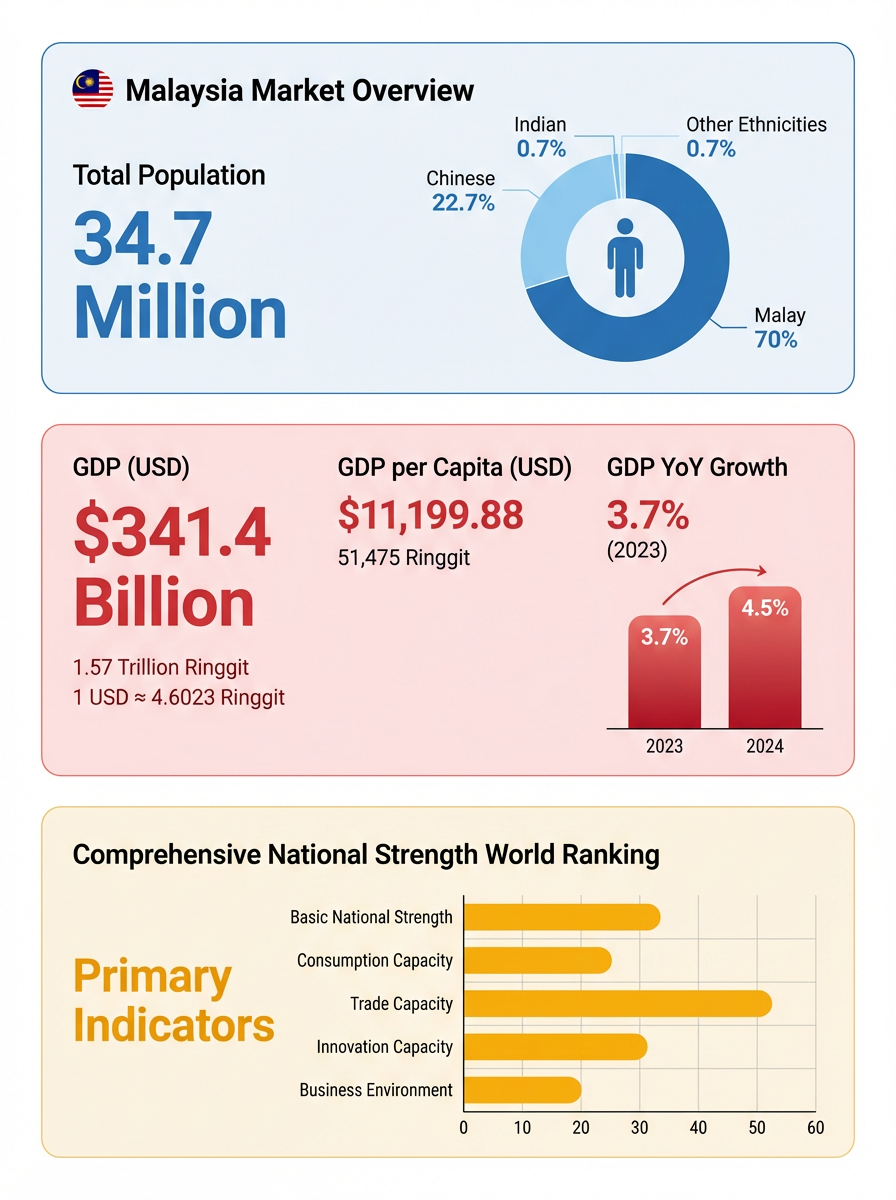

Population: Approximately 34.7 million (2024).

-

Economic Scale: 2023 GDP reached RM 1.57 trillion ($330B+), with a growth forecast of 4.5% for 2024.

-

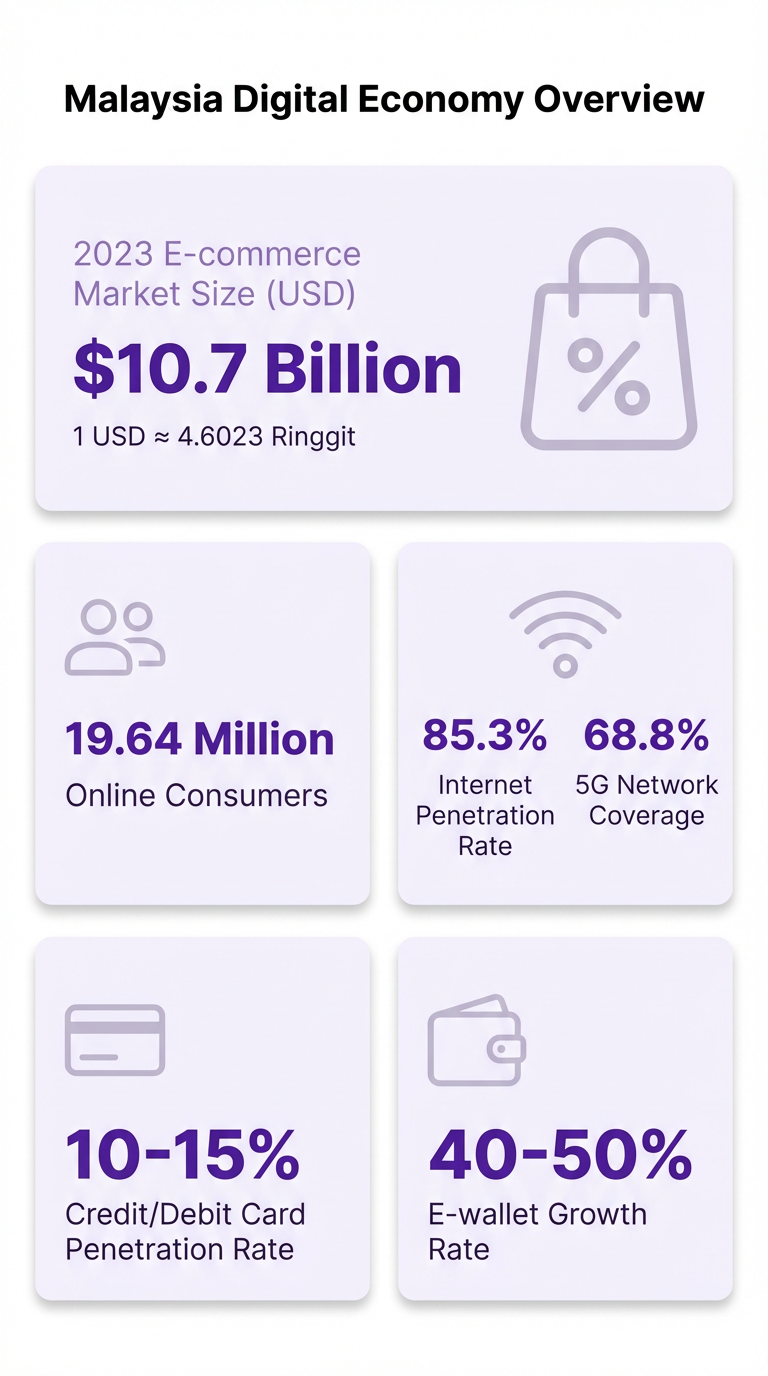

Digital Shift: Historically perceived as "slow-paced," Malaysia's digital adoption has accelerated post-pandemic.

-

Cash Usage: Dropped by 64%, while e-payments rose by 18%.

-

Financial Inclusion: The unbanked population has shrunk to just 12%, marking significant progress.

01. Economic Overview: A Strategic Hub

Malaysia's competitive advantage lies in its strategic geography, rich natural resources, and skilled workforce.

-

GDP Growth: Recorded a 3.7% growth in 2023.

-

Trade: Total trade volume hit RM 2.64 trillion, reinforcing its status as a key global trading partner.

02. The Digital Economy: From "Slow" to "Surge"

Just six or seven years ago, QR codes were a rarity in Malaysia. Today, the landscape has transformed.

-

Government Goals: The Digital Economy Minister, Gobind Singh Deo, projects the digital economy will contribute 25.5% to GDP by next year.

-

Consumer Behaviour: 22% of Malaysians now cite e-payment as their preferred method. The government is heavily investing in digital infrastructure to support this shift.

03. The Payment Battlefield: FPX vs. E-Wallets

1. Bank Transfers (FPX)

FPX (Financial Process Exchange) is the backbone of Malaysian e-commerce.

-

Dominance: It accounts for 43% of all electronic payment transactions.

-

Function: Allows users to complete real-time online transfers using their existing bank credentials.

2. E-Wallets

- E-wallets have become essential, especially among the youth. The market is competitive, with many users holding multiple wallets simultaneously.

3. Cash

Despite the digital surge, cash remains king in specific contexts.

-

Usage: Nearly half of Malaysians use cash daily.

-

Rural Areas: In non-urban regions, cash usage remains as high as 63.8%.

4. QR Payments (DuitNow)

DuitNow, managed by PayNet (Central Bank designated), enables real-time payments via mobile numbers, MyKad (ID) numbers, or passports, creating a unified QR standard.

04. Key Players: The Super Apps

Malaysia has a high internet penetration rate of 96.8% (33 million users), fueling the rise of super apps.

1. Touch 'n Go eWallet (TnG)

Originally a toll card for highways, Touch 'n Go has transformed into Malaysia's market-leading e-wallet.

-

Joint Venture: A partnership between CIMB and Ant Financial.

-

Ecosystem: Covers tolls, retail, movies, and bill payments.

-

Features: Offers WalletSafe protection and investment products (Go+). It is the most dominant wallet in the country.

2. Boost

Backed by Axiata (telecom giant), Boost is one of the fastest-growing local wallets.

- Touchpoints: Over 140,000 online and offline locations.

- Focus: Strong lifestyle integration (dining, shopping) and a popular rewards program.

3. ShopeePay

Part of the Sea Group ecosystem, ShopeePay leverages the massive traffic of the Shopee e-commerce platform.

- Integration: Seamlessly integrated with online shopping and accepted for Apple services (App Store, iCloud) in Malaysia.

4. Mcash

A pioneer licensed by Bank Negara Malaysia since 2016.

- Niche: Focuses on micro-payments, parking, and bill payments, serving over 400,000 members and 10,000 merchants.

Conclusion: Seizing the "Tiger's" Tail

Malaysia's digital payment market is in a "Goldilocks" phase—early enough for high growth, but mature enough for stable infrastructure. For global enterprises, the key to success lies in localization. You cannot rely solely on credit cards; you must integrate FPX and local wallets like Touch 'n Go.

Waffo empowers your expansion

by aggregating these fragmented payment channels into a single solution, ensuring you can serve every Malaysian customer seamlessly.