In the era of Product-Led Growth (PLG), a lean AI team can deploy globally on day one. However, the transition from "free beta" to global subscription monetization often hits a wall of payment failures, skyrocketing chargebacks, and complex structural compliance flaws. Last week, Waffo, a leading provider of Global Payments Merchant Services, joined industry leaders at the "Evolution Field" forum in Shanghai. The closed-door session, co-hosted by the Beyond the Road community and Citic Bookstore, brought together six practitioners to dissect the "full-stack" realities of global expansion, from PLG (Product-Led Growth) strategies to the labyrinth of international payment compliance. Decoding the Payment "Black Box" Eric Chu, CMO of Waffo, presented a pragmatic "Survival Guide" for AI developers, focusing on the two pillars of digital longevity: capital security and user retention optimization.

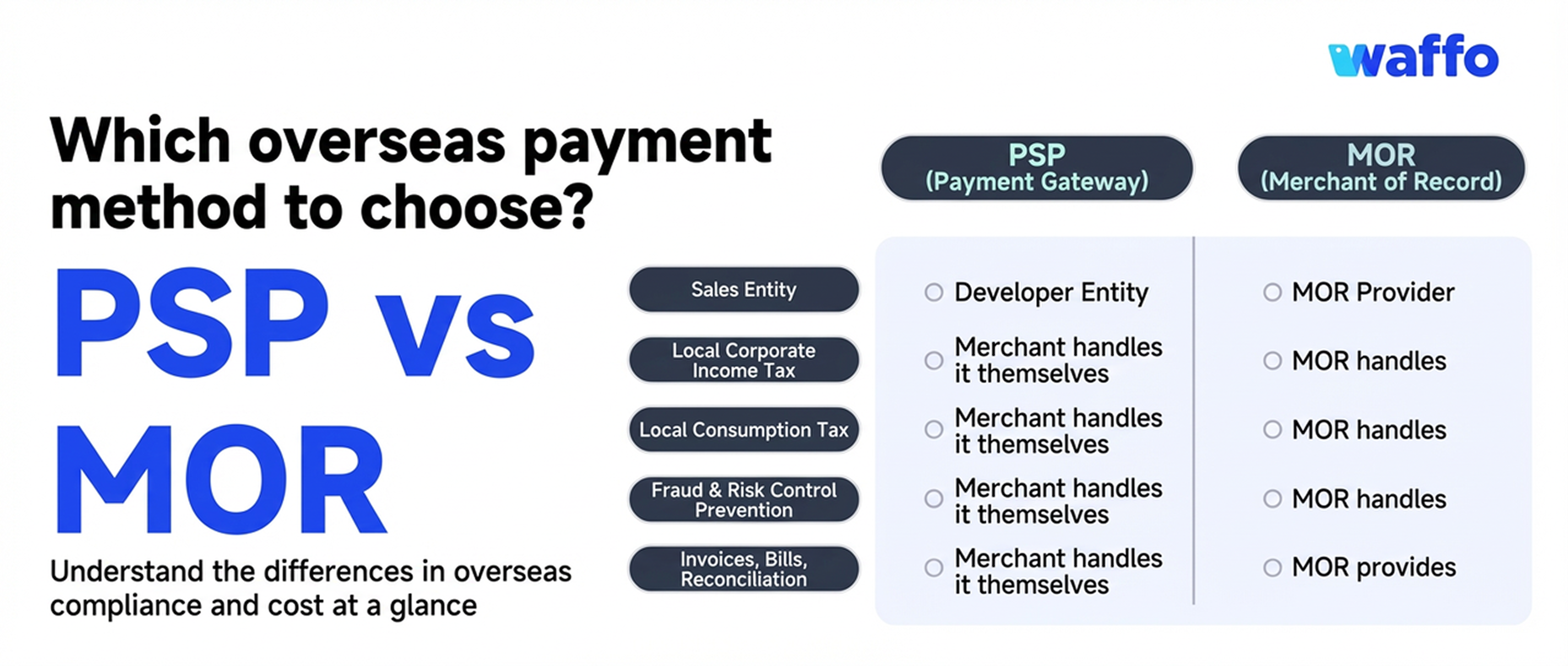

PSP vs. Merchant of Record (MOR): Choosing the Right Architecture For AI startups, the first "compliance hurdle" is structural. Chu provided a comparative analysis of the Payment Service Provider (PSP) model versus the Merchant of Record (MOR) model. In the 2026 fiscal landscape, picking the wrong architecture can lead to a compounding "tax drag." Waffo’s MOR solutions automate global VAT/GST handling and consumption tax compliance, allowing AI founders to bypass the administrative "compliance tax" entirely. Automated Defense Against "Friendly Fraud" AI and SaaS ventures often suffer from high payment dispute rates due to a lack of physical shipping evidence. Waffo transforms this "black box" into a verifiable chain of evidence. By leveraging Device Fingerprinting and user activity logs, Waffo provides an automated defense mechanism, insulating AI subscription revenue from malicious chargebacks. Precision Risk Management: Frictionless Growth Rather than "blunt-force" blocking, Waffo advocates for Surgical Security.

- Selective 3D Secure (3DS): Triggering authentication only for high-risk card bins to ensure a frictionless checkout experience for legitimate users.

- Trial-Hopping Prevention: Utilizing Small-value Pre-authorizations and Virtual Card BIN Identification to filter high-risk accounts before they drain server resources. Recovering Lost Revenue: From 70% to 95% Success Rates "Payment success rates are decomposable metrics, not mysteries," Chu noted. Waffo applies several technological levers to reclaim lost transactions:

- Smart Retries: Intelligent re-submission of transactions declined due to "insufficient funds."

- Local Merchant Acquiring: Improving authorization rates through Waffo’s localized Global Merchant Services infrastructure.

- Issuer Optimization: Fine-tuning metadata for specific banks to reduce arbitrary decline rates. Clearing the Path for AI Companies The forum underscored that the most draining challenges for AI developers are often external to code. Waffo’s mission is to handle the global payment infrastructure and tax compliance traps, allowing founders to focus on their core product "sprint" while Waffo clears the "hurdles."